Why are American brands taking over the UK QSR market?

Catering Today talks to Simon Chaplin, the pub, restaurant and franchise expert at Christie and Co about what is behind the proliferation of American fast food brands in the UK market

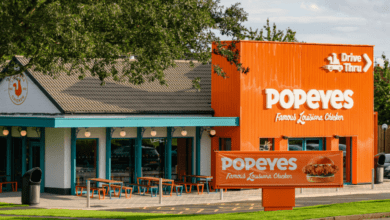

The British QSR market has seen an influx of American fast food brands coming into the UK and rapidly expanding. According to data from various sources there are over 6,500 American QSR sites in the UK.