SSP Group sees UK sales rise 12% in Q4

The group’s UK performance was driven by high demand in the air travel sector and a lower level of disruption in rail against the previous year

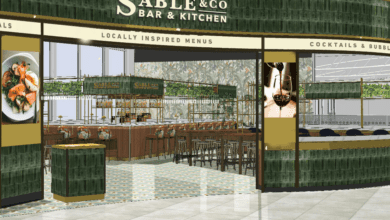

Operator of F&B outlets in travel locations, SSP Group, has reported that UK sales rose by 12%, with a like-for-like jump of 9%, during the fourth quarter ended 30 September.